Heloc with bad credit score

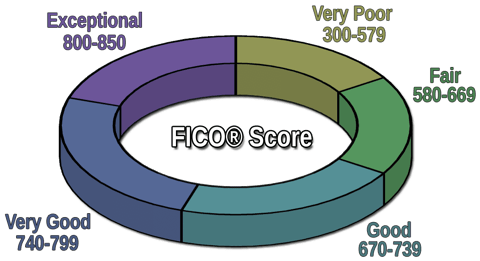

To get a home equity loan or HELOC with bad credit will require a debt-to-income ratio in the lower 40s or less a credit score of 620 or more and a home worth at least 10 to. While some home equity loans may still be available for borrowers with a credit score as low as 620 the interest rates are likely to increase steeply as scores drop below the.

How To Get A Home Equity Loan With Bad Credit Forbes Advisor

Bad credit can make it a challenge to get a HELOC even if you have built a lot of equity in your home.

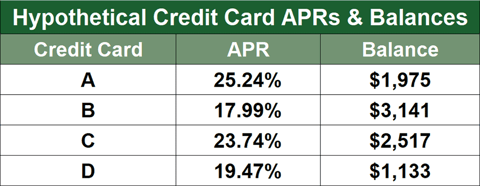

. These are the best HELOC. If you have significant high-interest debt using your home equity to pay it off will likely result in a lower interest rate. Verify you have at least 15 equity in your home.

Since your home secures a HELOC missing your monthly payments could put your home in jeopardy of foreclosure. A co-signer applies for your home equity loan. A home equity line of credit is often available to people with a poor credit score.

But in general a credit score of 700 or higher is preferred. Unlike the minimum credit. Could decrease your credit.

Wells Fargo Home Mortgage. For a Discover Home Loans fixed. Apr 12 2022 HELOCs.

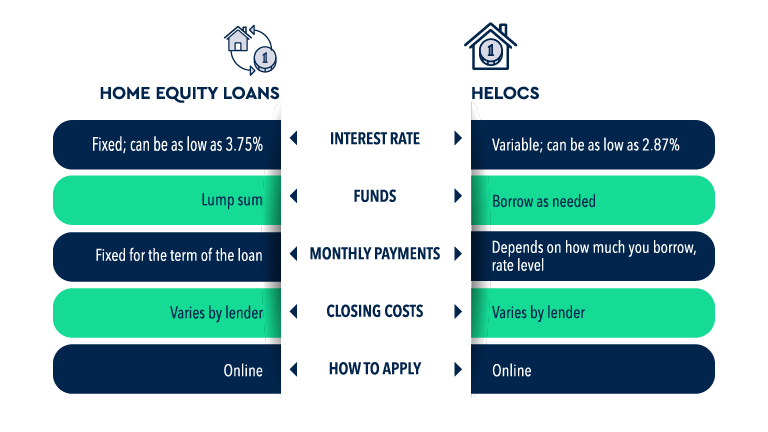

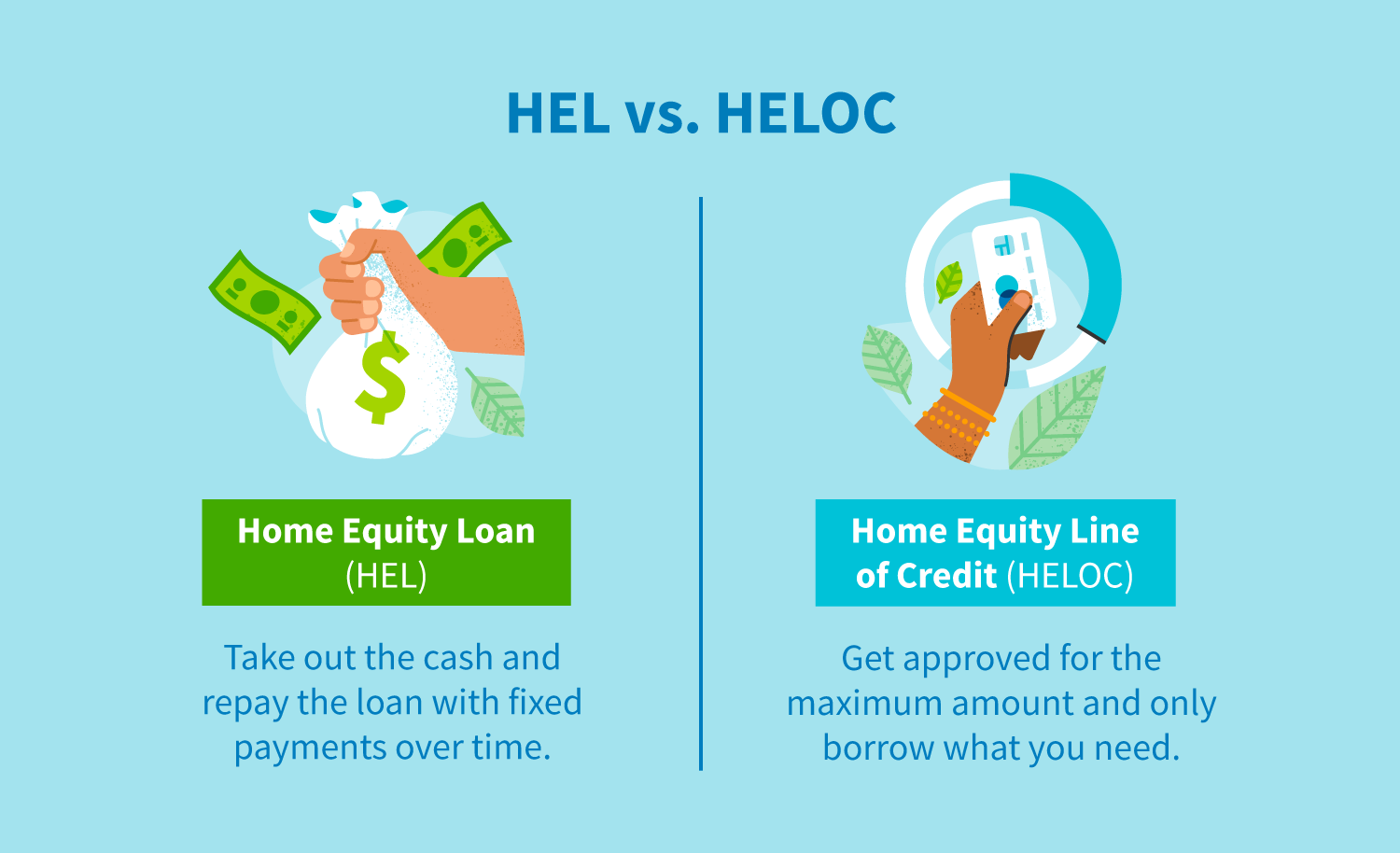

Different lenders will have different requirements for what credit score is needed for a HELOC. Often a home equity loan takes a second position behind a first lien mortgage. This means the lender disburses all the funds at once and you must repay them over the loan term.

Bad credit can weigh. Fixed Rate Home Equity Loans for. The cash-out proceeds will be available to you in a lump sum at closing.

The current average 10-year HELOC rate is 617 but within the last 52 weeks its gone as low as 255 and as high as. 23 hours agoThis generally causes HELOC rates to move up. Here are some program highlights.

Bad Credit HELOC Loan Options 5 or 10-year draws Interest Only Home Equity Line of Credit for Poor Credit. Best HELOC Lenders for Bad Credit September 2022. Home equity lenders typically lend up to a.

If your credit is poor enough that you dont qualify for a loan on your own applying with a co-signer may help. Most lenders look for a credit score in at least the good range to approve a home. Your house like a home equity line of credit serves as collateral to secure the loan.

Whether that effect is positive or negative will depend on how you manage your credit line. Home equity loans also typically have a fixed interest rate but the rate on. A HELOC can affect your credit score in different ways.

If youre getting a home equity loan with bad credit lenders will need to. However to get one you need to have a mortgage. Easy to OwnSM programs give options for those with lower income limited credit history and low down payment needs.

A HELOC is indeed a credit line that functions similarly to a credit or debit card. The average rate for a 10-year 30000 home equity loan.

Can You Get A Heloc With A Bad Credit Score Credello

Top 10 Mistakes In Acquiring A Home Equity Line Of Credit Line Of Credit Home Equity Home Improvement Loans

Can You Get A Heloc With A Bad Credit Score Credello

Pin On Refinance Home Equity Line Of Credit

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

Get A Home Equity Loan With Bad Credit Thecreditreview

How To Get A Home Equity Loan With Bad Credit Creditrepair Com

Take Advantage Of Home Equity Loan With Bad Credit Best Tips

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

3 Home Equity Loans For Bad Credit 2022 Badcredit Org

The Loan Vs The Line Of Credit Home Equity Loans Home Equity Loan Home Equity Home Improvement Loans

How To Access Home Equity With Bad Credit Hometap

Homeowners Are Sitting On A Record 6 Trillion In Equity Why Aren T They Using It Home Equity Equity Line Of Credit

Can You Get A Home Loan With Bad Credit

How To Get A Heloc With Bad Credit Easyknock

3 Home Equity Loans For Bad Credit 2022 Badcredit Org